CREATIVE DESTRUCTION

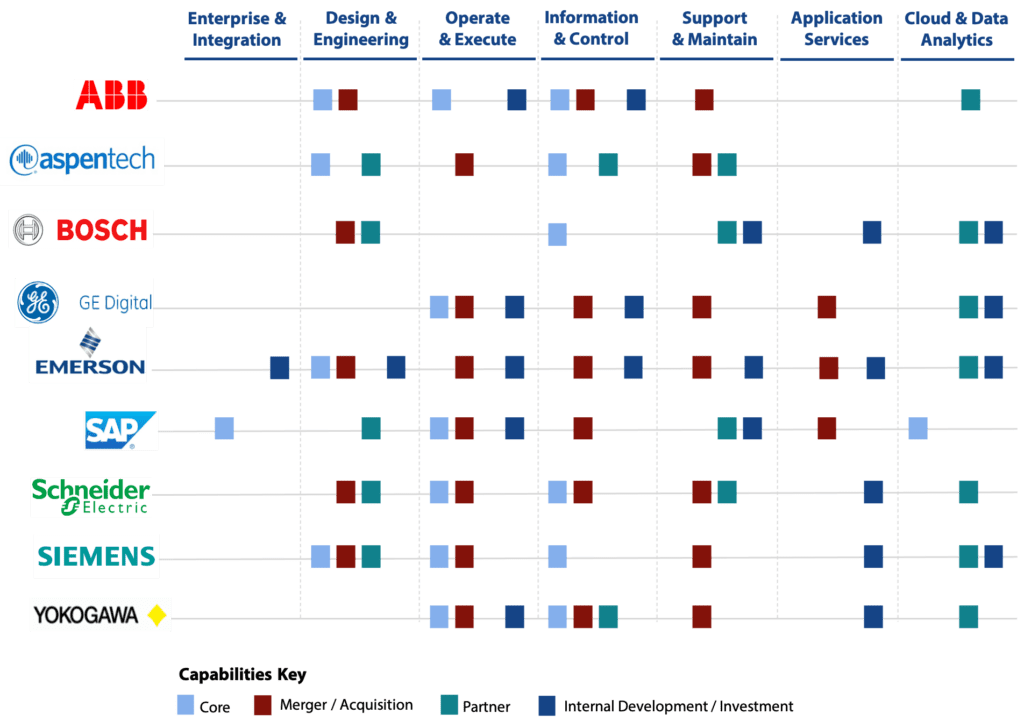

While software is not the sole agent of disruption, it is quickly becoming a dominant force and a disruptor for the largest diversified industrial equipment manufacturers. In many ways, the large OEMs have been deconstructing for decades. Companies used to develop all of the engineering, logistics, tools and processes they needed right inside their four walls. Today, no one thinks of a company as bound by the four walls of a building. Whether they know it or not, OEMs are becoming ecosystems now, value-delivery networks consisting of a disassembled set of business functions and entities—some owned directly, many sub-contracted, but all requiring orchestrated data and information. Just witness the growing number of re-structuring maneuvers and spin-outs companies like GE, Siemens, ABB, United Technologies, Danaher and more have initiated.

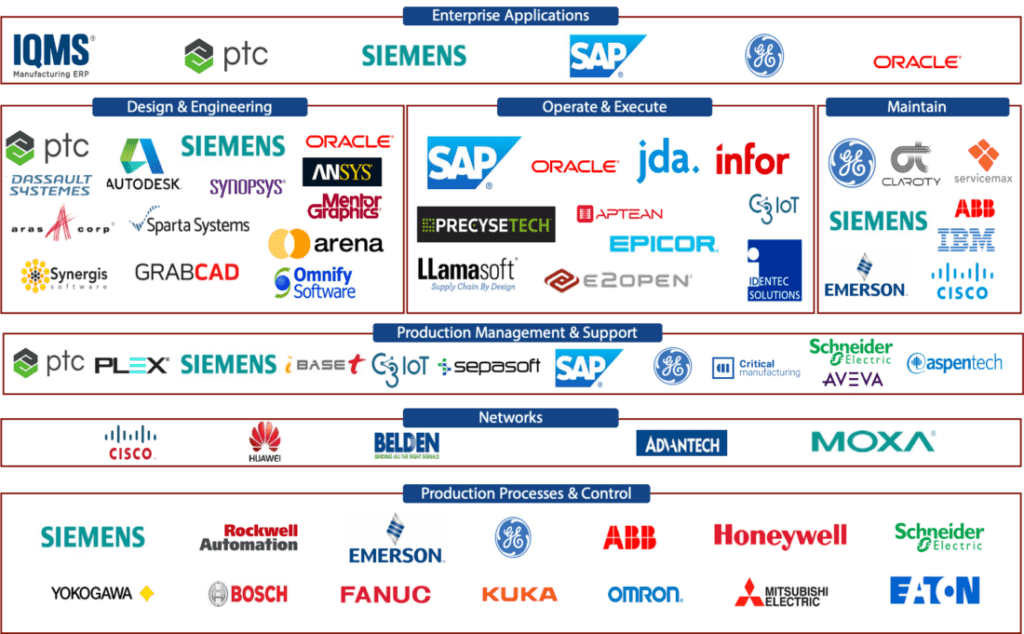

In the midst of these changes, many OEMs cannot see that the industrial software opportunity is far more significant than just capturing installed equipment services, or protecting aftermarket parts revenues, or “bolting on” new sources of revenue. The industrial software opportunity is moving well beyond the “servitization” trend many OEMs still find themselves challenged by. Incalculable value will flow from integrating assets into intelligent, adaptive systems. The architects of the next generation of software-defined solutions will drive that value and command it.

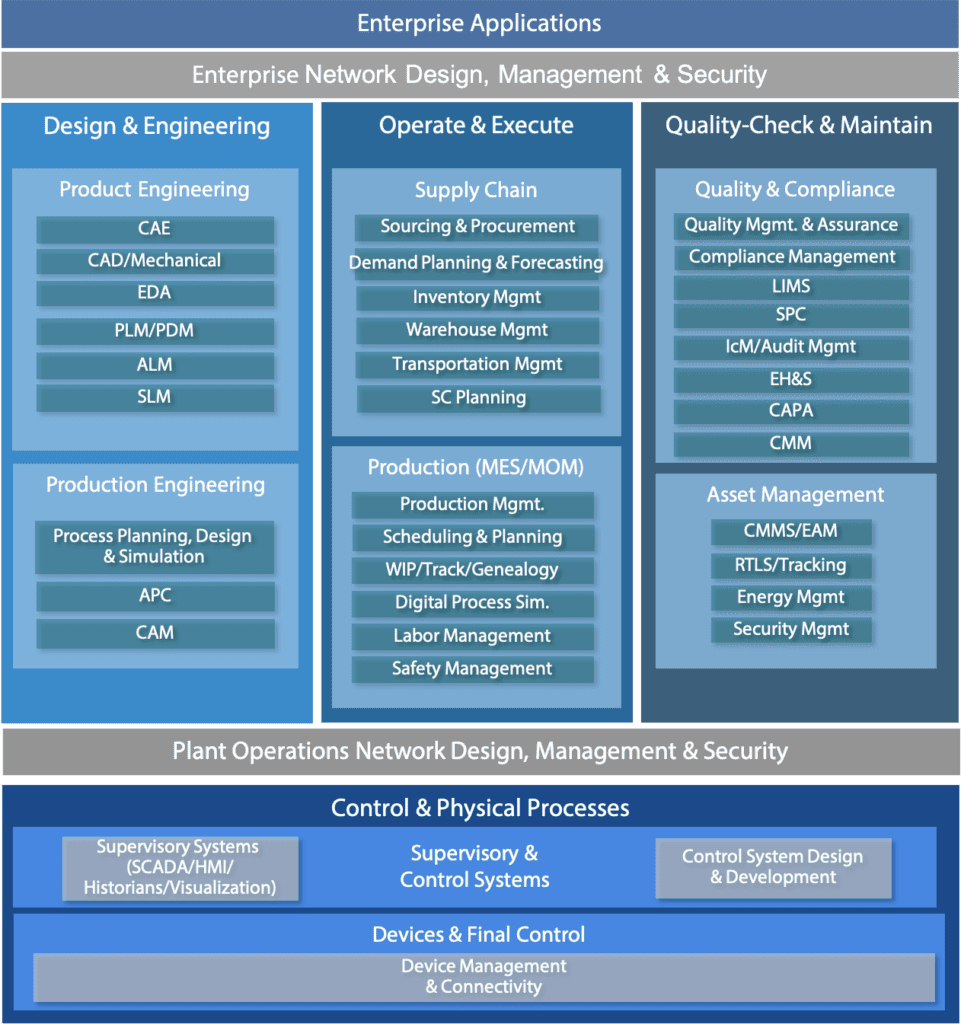

Perhaps the most important shift we see occurring is the relationship between software technology and business models, and the “role” that integration architecture and development platforms will play in enabling new solutions.

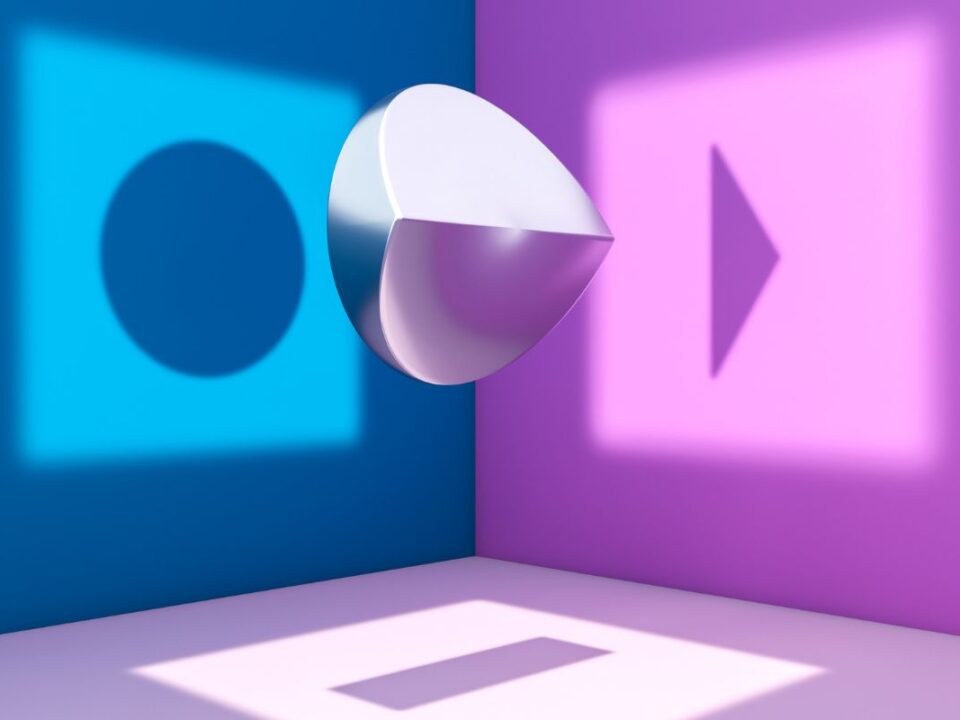

Our evolving “thesis” goes something like this: As the complexity of these systems increases, the number and diversity of stakeholders—users, sellers, supporters, benefactors, etc.—expands and the volume and nature of their interactions grows. The systems or “technology architecture” will become more and more tightly coupled to the “business architecture” and will, in turn, inform a radically new view of data and information-driven services that must be aligned with the corresponding business and revenue models. These two “architectures” must be viewed in close proximity. The two thrusts need to be mutually supportive without inhibiting one or the other.

However, trying to coordinate and leverage the respective roles of technology architecture and business architecture often creates contention. Many OEMs in this emerging arena that we speak with are coming to see the continuously evolving relationship between these two dimensions as fertile ground for innovation. They need to be interwoven and mutually supportive. In fact, from our own direct consulting experiences, we believe success in either arena increasingly goes to the company that effectively utilizes the combined potential of both.

Many people inside these companies get this, but many more have yet to assimilate the entire picture. These companies are large bureaucracies founded on hardware and products addressing focused markets. The era of Smart Systems will cut across traditional product P&L and market boundaries like a machete. If the major diversified, industrial behemoths don’t see the implications of this soon, a new category of player may emerge to fill the crucial role.