Proverbs for the Paranoid

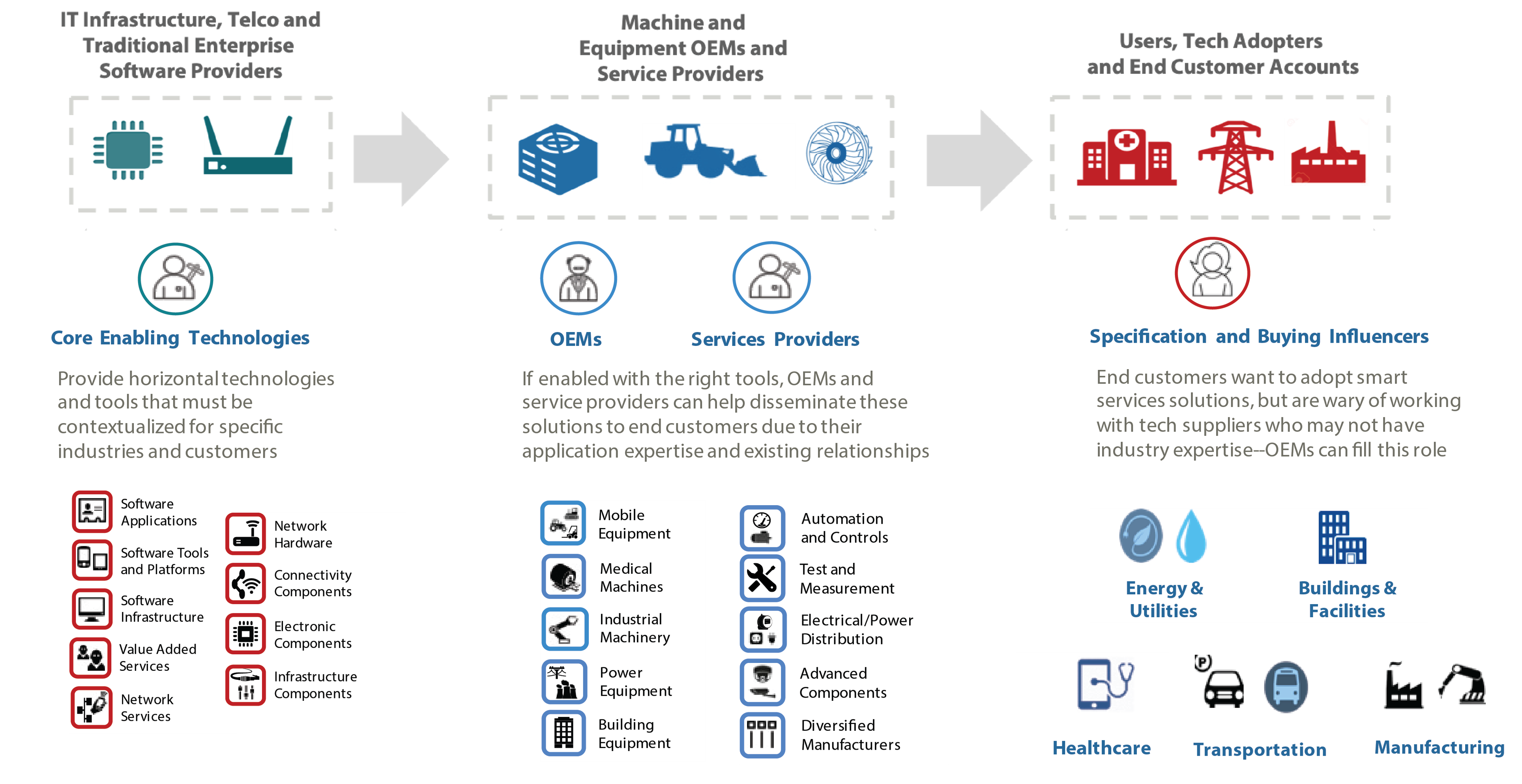

AI and open source software innovations are radically disrupting traditional machine and equipment OEM business and revenue models. To stay competitive, OEMs will need to sustain momentum in their core business while developing new digital and Smart Systems solutions. Thinking about this shift as just another “build, buy, partner” question can be dangerously misleading. It makes the required corporate culture and business model changes sound almost tame. They are anything but.

Machine and equipment players, particularly the largest ones like Siemens, ABB, Honeywell, Schneider Electric, Emerson, Bosch and more, continue to grapple with the shift in value from hardware to software. Many OEMs are trying very hard to leverage their core equipment businesses and value propositions with new software innovations. The question on everyone’s mind is, will any of these players really be able to break free from their past and create fundamentally new business models and value creation modes?”

Most of these OEMs share similar characteristics, organization structures, product development protocols, and sales and marketing practices. If you look at their history going back to the early 1990s, the OEM and equipment strategy playbook largely focused on global expansion, re-engineering, lean practices and acquisitions—all reasonable strategies at the time. But, somewhere between 2010 – 2015, OEMs realized that what worked in the past was less likely to work in the future. Indeed, many OEMs came to the realization that their traditional growth and value creation strategies had reached the point of diminishing returns.

AS SOFTWARE BECOMES PERVASIVE, WILL OEMS WIN?

source: Harbor Research

At about the same time, many OEMs started to observe the insanely higher multiples software businesses were realizing in the equity markets. They realized their product development organizations were embedding software into most of the things they were manufacturing. Beyond that, software as a service was becoming the norm. Suddenly, software was becoming as germane to their businesses as a bearing is to a mechanical assembly.

Today, management attention in most OEMs still focuses on the known, the predictable, and the quantifiable. Anything too difficult to measure is often treated as if it were unreal. Even more misleading is the assumption that by adding software to the mix, “business as usual” will prevail over a given planning period. Such assumptions leave little room for technology disruptions or the increased presence of unfamiliar competitors.

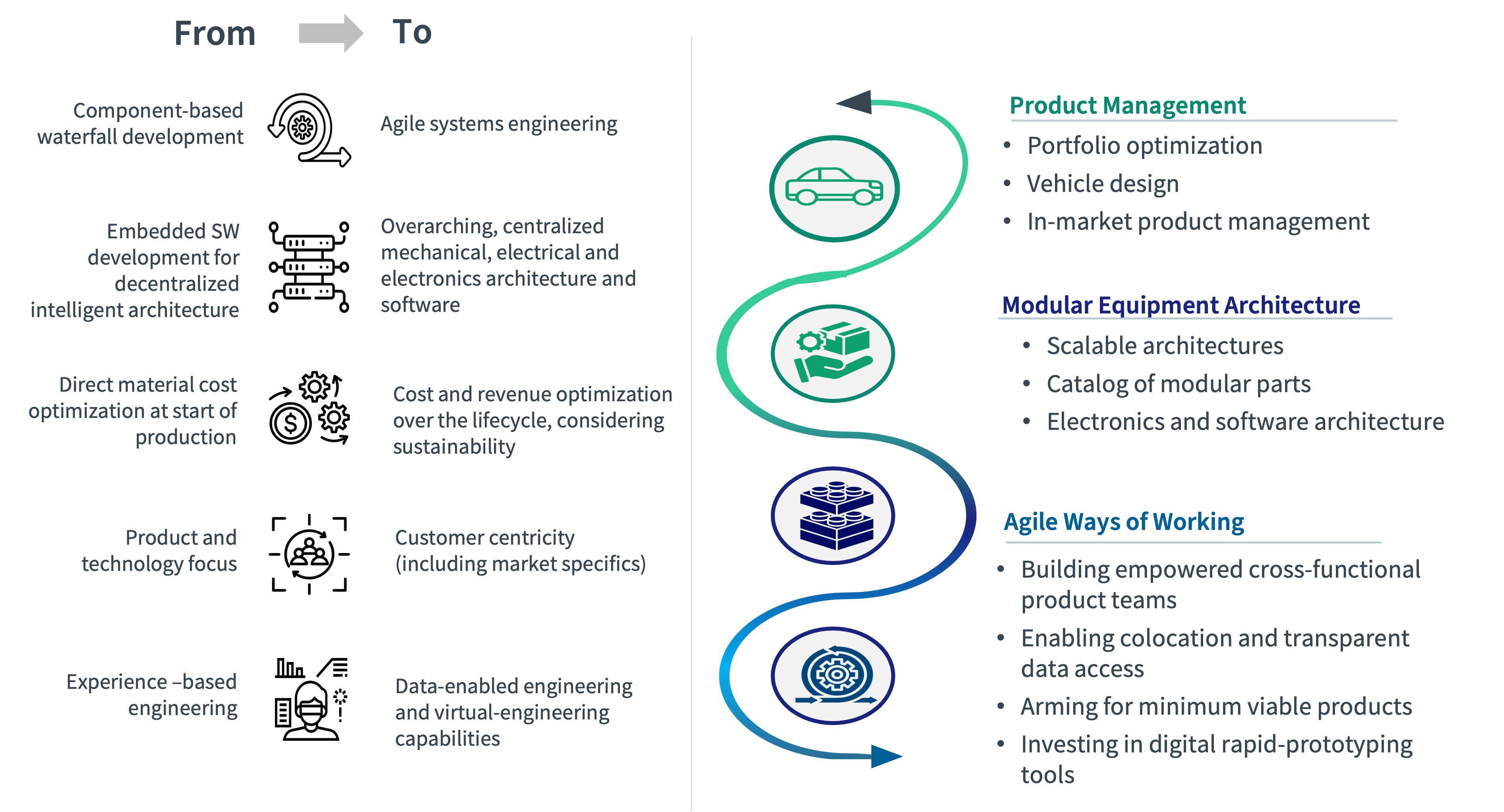

OEMs have long planning horizons with a built-in bias that reflects their established operating models. The significant differences in the strategies, business characteristics and operating models of the worlds of hardware manufacturing and software development cannot be overstated. Simply put, software lives in another world.

However, today’s OEMs continue to think that they can do anything, and everyone will have to keep playing by their rules. But, as software continues to invade their businesses, we believe that story is over.

OEMs Are Struggling To Develop Digital and Software Solutions

source: Harbor Research

A SEA-CHANGE TOWARD SOFTWARE-DEFINED MACHINES, EQUIPMENT & SYSTEMS

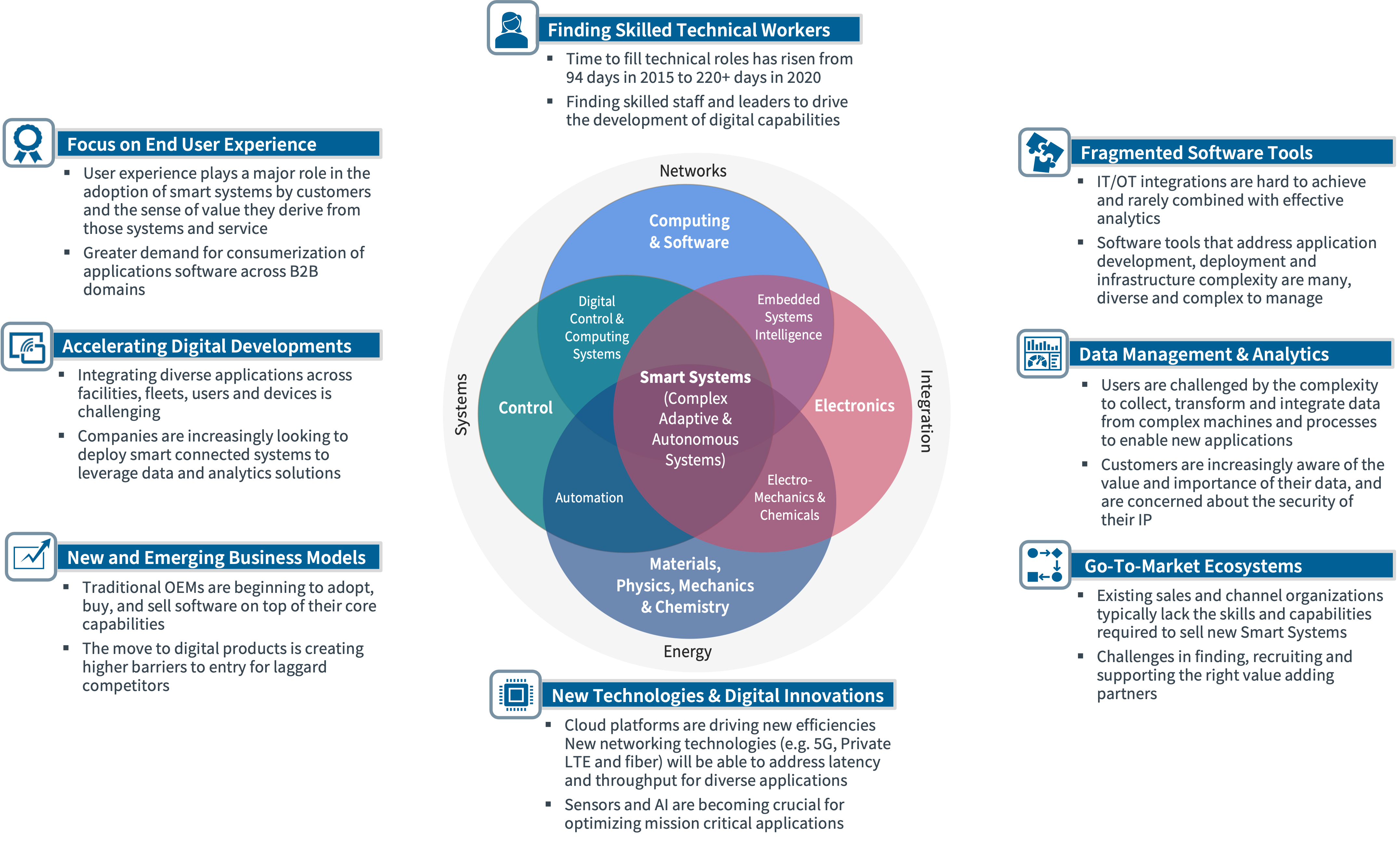

The fact that a rapidly expanding range of devices have the capability to automatically process and transmit information about status, performance and usage, and can interact with people, other devices and solutions anywhere in real time, points to the increasing complexity of application solutions. This only compounds when we consider the billions or more of networked devices that are being deployed.

As digital technologies continue to spread across the B2B and industrial arenas, designers have seen the growing value that comes from communications between sensors, devices and machines and the software that leverages the data flowing from connected systems. However, the impacts these innovations will have on existing business models does not stop with just software. As communications and software become deeply integrated and embedded into hardware systems, the world of mission critical systems will become software-defined and reprogrammable.

OEMs Face Increased Complexity As Well As Time and Cost Pressures

source: Harbor Research

The implications of these trends are enormous. No hardware product development organizations or supplier of componentry and sub-systems will be able to ignore these forces. Product and service design will increasingly be influenced by common components and sub-systems. Vertically defined, stand-alone products and application markets will increasingly become a part of a larger “horizontal” set of standards for hardware, software and communications.

As it becomes easier and easier to design and develop Smart Systems, competitive differentiation will shift away from unique, vertically-focused product features toward how the product is actually used and how it fosters interactions between and among users in a networked and data-driven context.

WHAT ROLE SHOULD SOFTWARE PLAY IN OUR BUSINESS?

If the upstream IT and telco “arms merchants” are addicted to horizontal technologies, then the true interpreters and vertically-skilled translators of these horizontal technologies ought to be the domain-fluent OEMs. They should be selling software like crazy, but that hasn’t always been the result. What we have been seeing more often than not is large B2B OEM’s software strategies stuck in “low gear” and trapped selling their software solutions to their largest installed base customers – essentially selling their software to their own captive hostages.

Even if we could oversimplify the Smart Systems and IoT opportunity as something that a company can seize alone, enable with focused partners, or pursue as an open collaborative opportunity, the path a company chooses to take to embrace new software opportunities will largely determine the business model it should adopt. If it’s all so straightforward, why aren’t we seeing more hockey-stick growth, and why have there been so many failures?

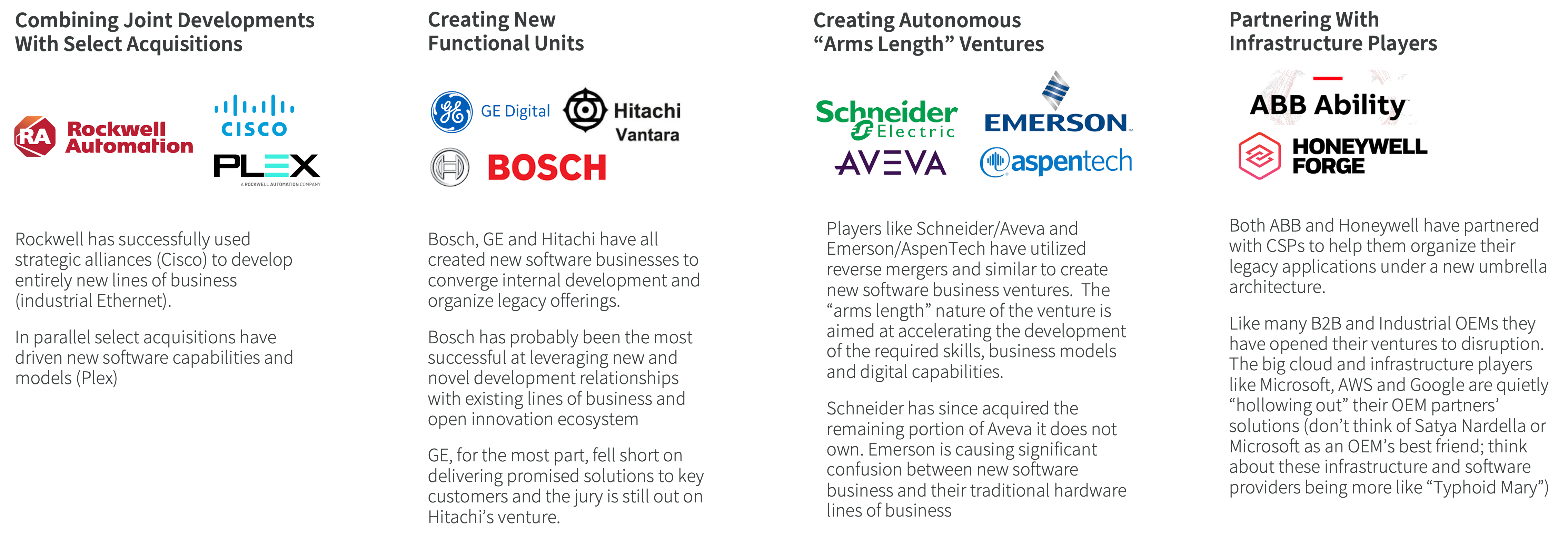

Rather than asking the tougher questions that address new software business models and solution-delivery modes, what we are seeing is far too many OEMs asking the classic question, “Should we build, partner or buy?” It’s no wonder that so many OEMs have defaulted to acquisitions and just “bolting on” these new software businesses.

While many will point to a specific OEM’s software strategy, lack of marketing investment, or potential technical missteps as the cause of such failures, Harbor believes that many of them can be traced to a broader confusion about roles. Sometimes companies need to ask themselves, “Who are we, and what part should software play in our business and for our customers in the market?” Spectacular failures can occur when players either fail to ask the question or answer it wrong.

OEMs Have Pursued Multiple Paths To Developing Software & Digital Businesses

source: Harbor Research

CROSSING SOMEONE’S CHASM

Everyone we talk to in the OEM space is telling us the same thing: software is very challenging. Hardware players have never been good software players. They’ve never understood software culture, never learned to not confuse software with their own core equipment business and value propositions. And they have continued to think that they can acquire any business, and everyone will have to keep playing by their rules.

But that story is over. Software is now in everything. It’s indisputably eating the traditional profits and revenue models across many industries. Machine, equipment and hardware OEMs literally have no choice but to embrace the creation of code. The questions are: How, where, and to what ends?

Manufacturing companies have actually dealt with software for a long time. But their expertise has always been in hard-coded, purpose-built software embedded in their machines. You needed it to make the hardware work, so OEMs bundled the embedded software with their physical product and didn’t even charge money for it. They’d grown up in an environment that was all about physical control, and they remained challenged by software, code development, data acquisition, value and analytics.

ORCHESTRATING SOFTWARE INNOVATIONS

Machine and equipment businesses have been deconstructing for decades. OEMs used to develop the logistics, tools and processes they needed right inside their four walls. Today, no one thinks of a company as bound by the four walls of a building. Companies are ecosystems now, value-delivery networks consisting of a disassembled set of business functions and entities – some owned directly, many sub-contracted, but all requiring orchestrated data and information.

OEM management teams often live in two separate and competing worlds – running their core business as efficiently as possible while also needing to identify new and novel product and systems innovations. This strategic contention causes many OEMs to act like a deer in the headlights that’s caught between vastly different business models.

OEMs are struggling today to turn the operational data generated by their machines, equipment and fleets into tangible business value for their customers as well as for themselves. Extracting value from new connected equipment systems has proven to be much harder than anyone thought it would be.

These forces are driving many OEMs towards acquisitions and others to work with broader networks of external software developers and organizations including systems integrators (SIs), independent software vendors (ISVs), independent hardware vendors (IHVs) and more. However, sorting among the many diverse categories of software developers and players for the right collaboration partners has been challenging for OEMs.

To make matters worse, the software tools many designers and developers are working with today were not designed to handle the diversity of data types, the scope of interactions and the massive volume of data points generated; each new application requires too much customization and development resources just to perform many of the same basic tasks efficiently and effectively.

Existing web development platforms and so-called low-code frameworks offer a graphical UI to simplify the process of structuring a program, and then behind-the-scenes the system assembles the actual code that gives machines their instructions. Today’s typical web development platforms and low-code frameworks all manipulate the same programming problems, but their different solutions are locked away in a more tightly coupled data structure that their simplified UI hides from the user.

For OEMs, working with the wrong software tools, incomplete platforms or misaligned partners can limit the impact of new solutions and customer opportunities. New networked and software innovations are not just a new line of business OEMs can “bolt on” or subcontract out to third parties.

Success Factors for Driving Software, Digital & Smart Systems Growth Strategy

source: Harbor Research

Software development is undergoing significant changes. Radically new development modes and approaches are emerging. New generative AI models can automatically create the code from a software designer’s “design” reducing development time (from weeks and months to hours) and reducing development complexity (the high priced combination of software architects, designers and top-level software engineers). Open source software tools are amplifying AI’s impact on software development with code libraries that are modular and interchangeable and enable the re-use of software components across an ever-broader spectrum of development environments, partners, and domains.

Software application development is quickly becoming a new environment for designers and subject matter experts who don’t possess high-level coding skills short circuiting the traditional software developer tool chain. Data applications are at the heart of this convergence trend, enabling a whole new generation of digital solutions. OEM engineering and development organizations are reaching a critical juncture where they will need to carefully consider whether acquiring a software business or collaborating with players is the best path forward.

NEW MARKET AND SOFTWARE ROLES FOR OEMS

AI models, open-source software tools, cloud computing and distributed/edge silicon architectures are hardly new, but as the diversity, scale and nature of data interactions grows, the systems or “technology architecture” will need to become more closely coupled to the application logic or “business architecture” to inform and enable a new generation of data applications and services. These two “architectures” must be tightly interwoven and mutually supportive without inhibiting one or the other.

Aligning and leveraging the respective roles of technology architecture and business architecture often creates contention, but we are entering an era where success in either dimension will increasingly go to the OEMs that effectively utilize their combined potential.

If software continues to become pervasive across any machine, equipment or hardware business then what are the new and unique strategic roles and differentiated business models that OEMs can embrace to drive new software opportunities and catalyze growth?

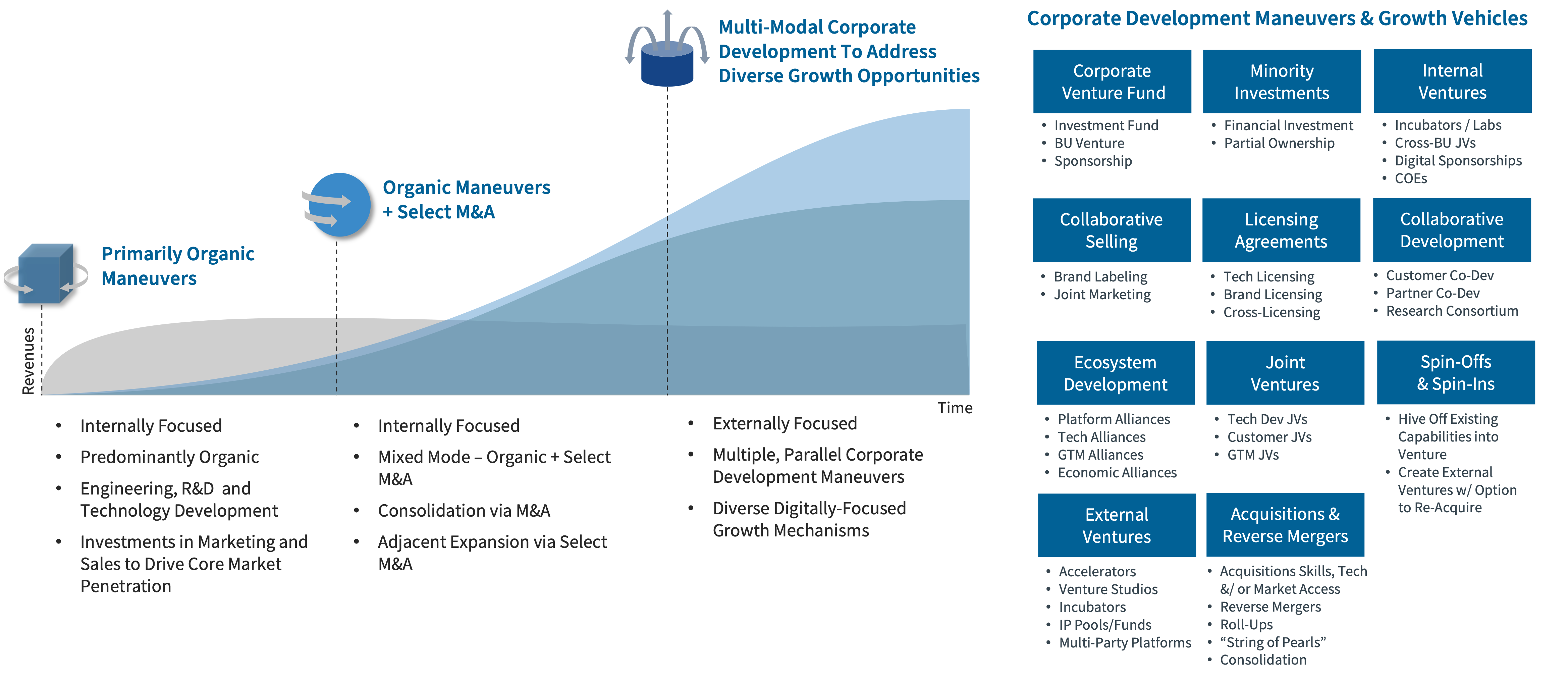

Determining the Mix of Capabilities & Maneuvers To Drive New Software Businesses

source: Harbor Research

As technologies mature and open standards become the norm, applications based on deeper, peer-to-peer interactions between devices, data, systems and people will drive new dynamic value streams. This opens new collaborative business model opportunities for OEMs that have the potential to drive much greater value for the customer. Understanding the business-model design trade-offs, organizational and relationship structures, and the key interactions and combinations of them will be critical to success.

We believe that successful market development will require established OEMs to develop new software ventures as well as new relationships with specialized innovators and developers to enable larger ecosystems and the positive synergies and values that flow from them. These new roles are progressive in the sense that the value increases with the integration of each additional player’s equipment, systems, data, and, most importantly, the increased value resulting from new and diverse interactions.

Hence, the question shifts from should I build, partner or buy to a combination of all three. This new generation of collaborative application services, and the significant increase in interaction value they inform, inevitably requires open information flows and shared data across the ecosystem and its participants. Orchestrating data and information value based on the integration of relationships across new ecosystems will become the “order of the day” for new Smart System solutions.

Software architecture is quickly becoming the foundation of every technology-driven organization; not just electronics and software companies but every company building digital capabilities. However, relatively few players understand how dramatically the software development arena has begun to change and the strategies they need to maximize value. For many OEMs we have observed, just combining aging monolithic applications with new “cloud veneers” and SaaS delivery just won’t cut it.

Some executives inside these companies get this, but many more have yet to assimilate the entire story. The era of Smart Systems will cut across traditional product P&L and market boundaries like a machete. If the major diversified, B2B and industrial players don’t see the implications of this soon, a new category of players may emerge to fill the crucial role. ◆

“The Software Paradox” is distilled from our Technology Overview ”OEM Software Growth Opportunities.”

Fill out the form below to download a more extensive report for free.