OEM management teams often live in two separate and competing worlds – running their core business as efficiently as possible while also needing to identify new and novel product and systems innovations. This strategic contention causes many OEMs to act like a deer in the headlights between vastly different business models.

OEMs are struggling today to turn the operational data generated by their machines, equipment and fleets into tangible business value for their customers as well as for themselves. Extracting value from new connected equipment systems has proven to be much harder than anyone thought it would be.

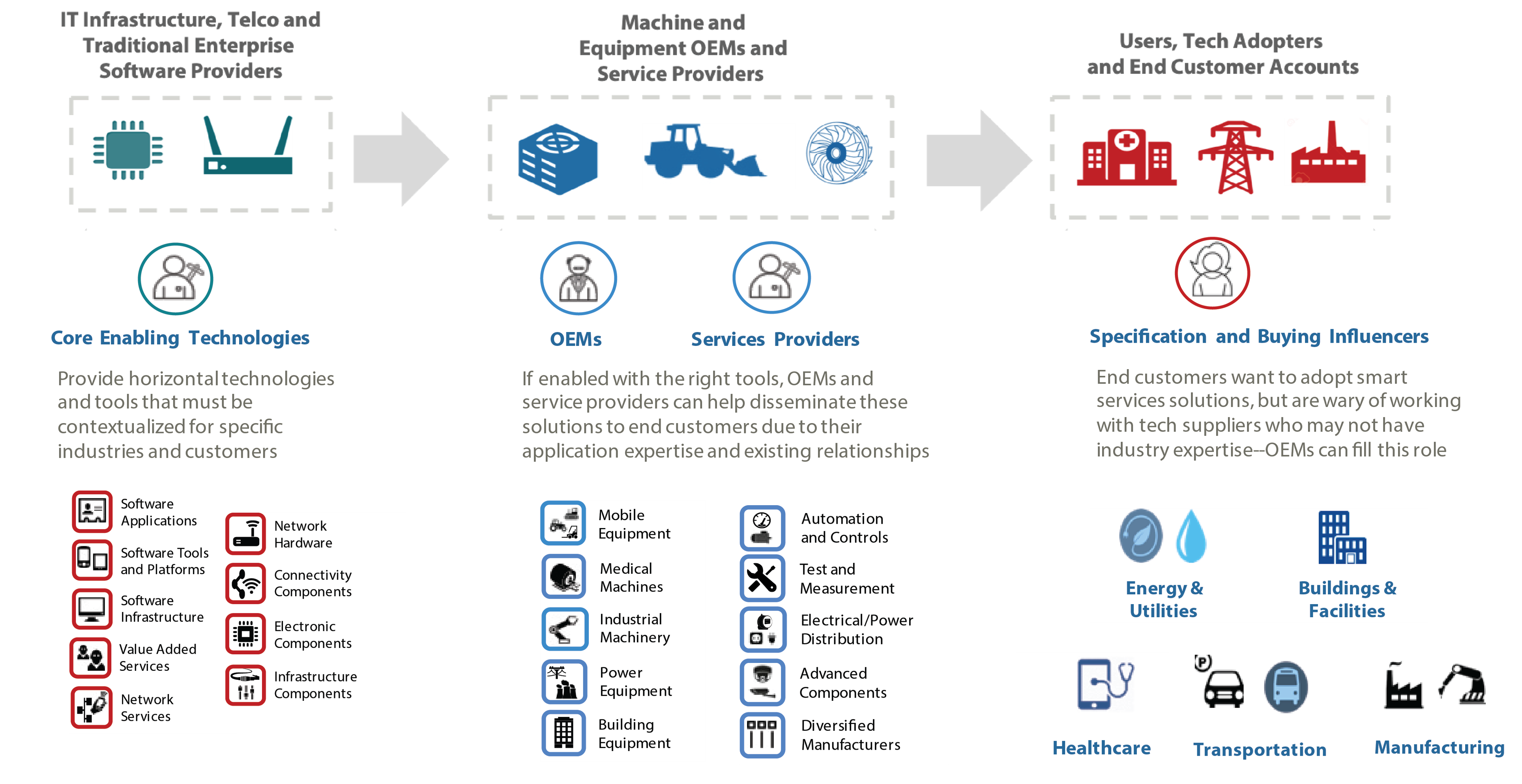

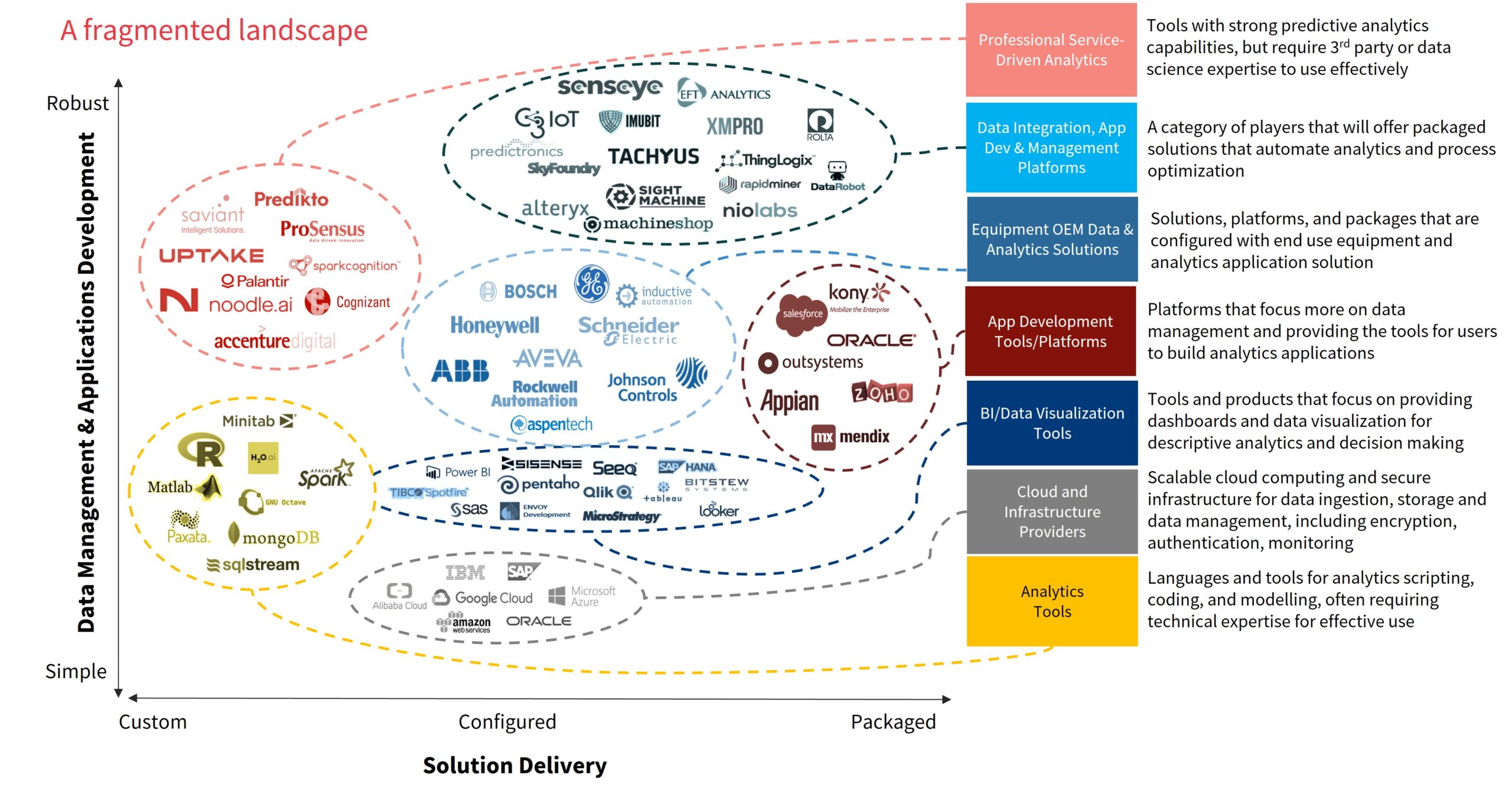

These forces are driving many OEMs towards acquisitions and others to work with broader networks of external software developers and organizations including systems integrators (SIs), independent software vendors (ISVs), independent hardware vendors (IHVs) and more. However, sorting among the many diverse categories of software developers and players for the right collaboration partners has been challenging for OEMs.

To make matters worse, the software tools many third party players are developing or working with today were not designed to handle the diversity of data types, the scope of interactions and the massive volume of data points generated; each new application requires too much customization and development resources just to perform many of the same basic tasks efficiently and effectively.

Existing web development platforms and so-called low-code frameworks offer a graphical UI to simplify the process of structuring a program, and then behind-the-scenes the system assembles the actual code that gives machines their instructions. Today’s typical web development platforms and low-code frameworks all manipulate the same programming problems, but their different solutions are locked away in a more tightly coupled data structure that their simplified UI hides from the user.

For OEMs, working with the wrong partner, platform or software tools can limit their solution impact and constrain customer opportunities. New networked and software innovations are not just a new line of business OEMs can attach to their existing organizations.

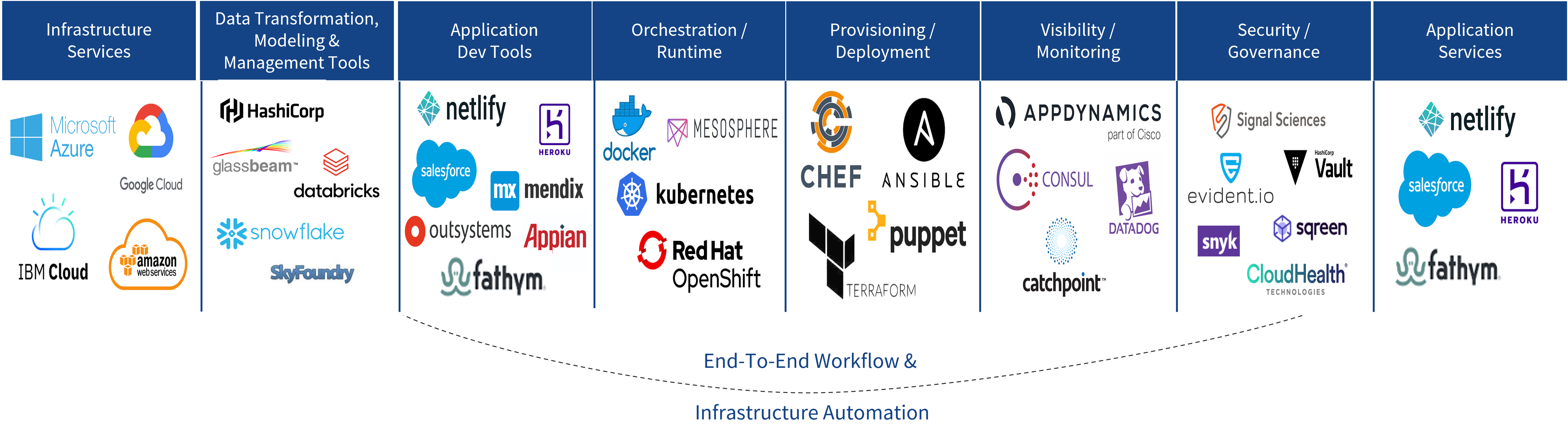

Open-source software tools, cloud computing and distributed/edge architectures are hardly new, but as the diversity, scale and nature of data interactions grows, the systems or “technology architecture” will need to become more closely coupled to the application logic or “business architecture” to inform and enable a new generation of data applications and services. These two “architectures” must be tightly interwoven and mutually supportive without inhibiting one or the other.

Software development and realization is undergoing significant changes. Radically new development models and approaches are emerging where open-source software development tools and libraries are modular and interchangeable and where automation of software development and re-use of software components can be realized across an ever-broader spectrum of development partners, communities and domains.

Aligning and leveraging the respective roles of technology architecture and business architecture often creates contention, but we are entering an era where success in either architecture dimension will increasingly go to the OEMs that effectively utilize their combined potential.

Data applications are at the heart of this convergence trend, enabling a whole new generation of digital solutions. OEM engineering and development organizations are reaching a critical juncture where they will need to carefully consider whether acquiring a software business or collaborating with players is the best path forward.

For OEMs, working with the wrong partner, platform or software tools can limit their solution impact and constrain customer opportunities. New networked and software innovations are not just a new line of business OEMs can attach to their existing organizations.