Value and profitability are playing a new game of hide-and-seek. They’re still there, but not where they used to be. If you keep looking in the same old places…well, you know what’s going to happen.

The world of pure thought is displacing physical hardware and replacing labor-intensive services in nearly every market and niche application imaginable, and it shows no signs of slowing down. In one form or another, every company is becoming a software company, but not always because they wanted to, and not always with brilliant success.

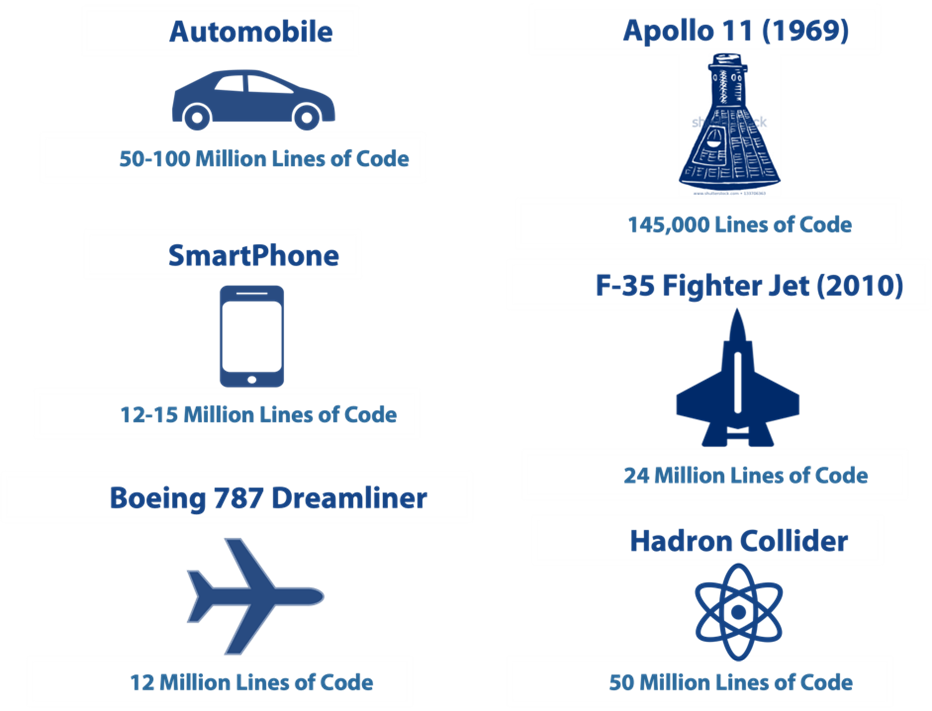

When we use the term “hardware OEMs” we mean the manufacturers of equipment, machines, and myriad devices that are used in everything from heavy industry, to commercial services, to individual homes. In their world, code continues its relentless march into everything. This fact is indisputably disrupting the traditional revenue and profit models of many industries, from heavy industry to smart homes. The hardware OEMs have literally had no choice but to embrace software.

The questions are: How, where, and to what ends?

There was a time when machines weren’t intelligent at all. Now they’re all potentially intelligent. Today, equipment manufacturers and OEMs have software embedded in most of the things they make, and beyond that to the services they offer. But their expertise has always been in purpose-built software embedded in their machines or devices—software that was necessary to make the hardware work. These code-products went by names like firmware, configuration programs, or data acquisition systems, and OEMs bundled them with their physical products, usually not even charging money for them.

SOFTWARE IS BECOMING PERVASIVE IN OEM EQUIPMENT

Suddenly, software is as germane to physical manufacturing as a bearing is to a mechanical assembly. Further, the definition of an intelligent machine is a moving target. At the end of the day, any product that can be networked and made more intelligent will be, and as that evolves from simple sensing and monitoring to AI, machine learning, and autonomy, the world of the OEMs will change radically.

End customers of equipment OEMs are accelerating this trend. Users of the OEMs’ devices for energy management in the home, patient diagnosis in the hospital, or the behavior of robots on a factory floor have woken up to the extraordinary value represented by networked machines and the software applications that run on them.

Engineers and developers working inside OEMs have always wanted to better serve their constituencies by making their equipment and devices do more things, interact with relevant devices or systems, and in general provide new values to the user. But in many cases, that’s been harder to accomplish than anyone imagined.

This has left the OEMs open to disruption from multiple directions. On one side are the big IT and cloud computing players like Microsoft, Google, and AWS. On the other side it’s the OEM’s customers, who are now saying, “We’re having trouble continuing to work with you. You’re not providing technologies that allow us to use our data the way we want to, or to integrate with other ‘things’ you don’t make, or to create new application and services values in our world.”

BUY VERSUS BUILD

If the upstream IT and telco arms-merchants are addicted to horizontal technologies like cloud computing and 5G networks, then the true interpreters and vertically skilled translators of these horizontal technologies ought to be the domain-fluent OEMs. Because of the primacy of the machine or device—think automobile, MRI machine, factory robot—the software revolution should primarily be an opportunity for incumbents, meaning the hardware OEM.

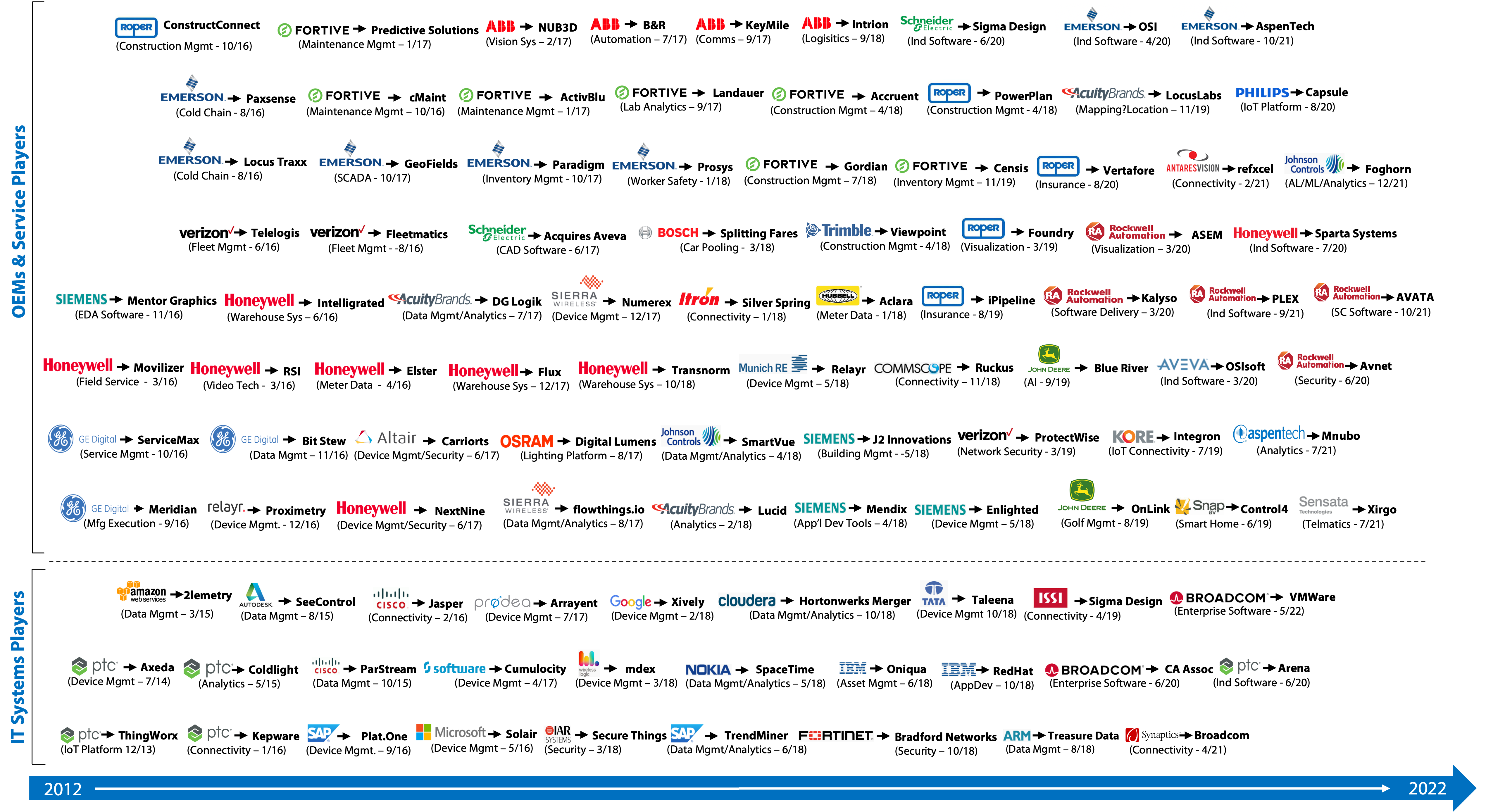

And it is a fact that the continuing expansion of IoT and Smart Systems is opening up many new growth opportunities for OEMs. A diverse range of OEMs and hardware businesses have been investing large sums of money and resources in new software and data analytics solutions. Thus far, however, the results of these efforts have been mixed at best, leaving many equipment and machine OEMs failing to meet their growth revenue goals.

If these indicators are true, and we believe they are, then OEMs need to be thinking about the new business and operating models they need to embrace to capture the value of software. And yet, rather than asking the tough questions that address new software business models and solution-delivery modes, far too many OEMs default to the classic and simpler quandary, “Should we build or buy?”

Since most OEMs don’t know how to develop software on their own, or how to be in the software business, many of them have responded by acquiring software businesses. However, when OEMs buy software companies, they face the challenge of keeping them close enough to get synergy, but not so close that they strangle a strange business that is fundamentally alien to them.

OEMS NEED TO CONSIDER MORE THAN JUST MAKE VS BUY

WHAT ROLE SHOULD WE PLAY? WHAT BUSINESS AM I REALLY IN?

As connectivity, sensors, software and new technologies invade virtually every OEM segment across the business landscape, is it time for OEMs to stop thinking of themselves as “hardware” businesses and begin to think of themselves as software systems and solutions businesses?

Because the Smart Systems and IoT opportunity is very complex and has evolved slowly and unevenly, the scale, scope and sophistication of today’s solution players has not evolved very far. To the casual observer, there doesn’t appear to be a significant number of OEM players that have systematically addressed this transition. It’s no wonder that there have been so many acquisitions.

While many will point to a specific company’s strategy or potential technical missteps as the cause of such failures, Harbor believes that many of them can be traced to a broader confusion about roles. Sometimes companies need to stop and ask themselves, “Who are we, and what part do we play in the market?”—and their answers to these questions need to be correct. Spectacular failures occur because leadership teams either answer the questions wrong or fail to ask them at all.

The Smart Systems opportunity presents multiple challenges—from core technology innovation to new business models, different ecosystem and channel relationships, and on and on. This market opportunity represents a very complex set of inter-related elements, but many participants are coming to see the outsized role software will play. Designing a successful “software” business involves optimizing all dimensions, not just the technical elements.

OEMs should be thinking about the new and unique strategic roles and differentiated business models that they can embrace to drive new software opportunities and catalyze growth. Their mindset has to grow far bigger than just software M&A.