Future Proof Computing Lives at the Edge

New Smart Services Strategy and Solution Development

Partnered With Private Equity Fund To Develop Investment Thesis and Acquisitions Strategy Focused On IoT Networking Technologies

Description

We engaged with a private equity fund that wanted to explore investment opportunities in the Internet of Things arena and wanted assistance with determining if this was an attractive opportunity, what their investment thesis might focus on and the availability of attractive investment and acquisition candidates.

Challenge

This private equity firm wanted to see if “higher” technology-focused growth opportunities were stable enough and had positive growth prospects to align with their fund’s institutional investors. Their hypothesis focused on a key dimension of the IoT arena: that while new wireless networks were a more volatile technology and market space to enter into, the assets and businesses that would be adopting these new networks and communications capabilities were established players in their markets and would therefore offset any volatility.

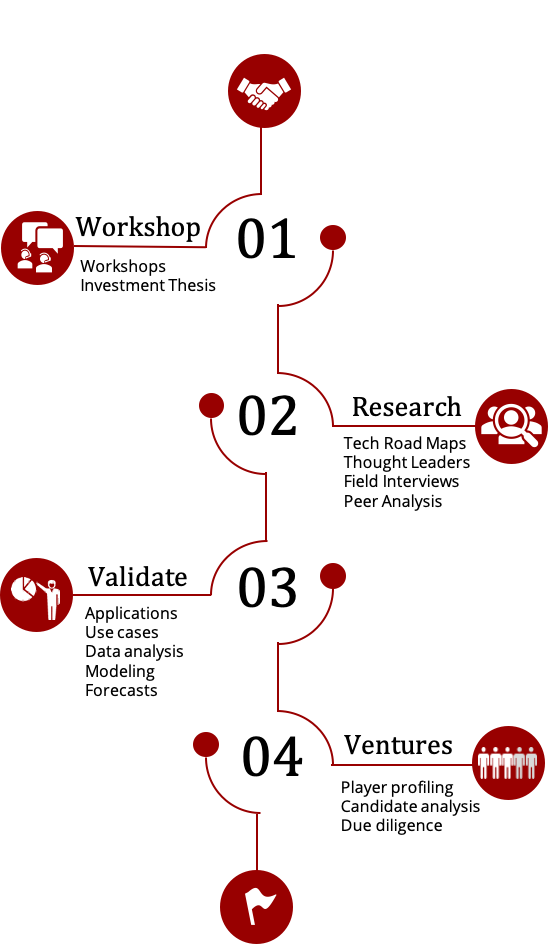

Process and Outcomes

Based on our ongoing research work, we quickly pulled together a initial investment thesis surrounding IoT networks including which industries, applications and use cases were likely to be the most attractive opportunities.

We then conducted an in depth assessment of potential acquisition candidate companies comparing the group to a set of peer companies we identified during the development of the initial investment thesis.

Our next step was to create a more detailed short list of growth opportunities and candidates to model to help quantify the opportunities. We then organized and presented our analysis to the fund managers along with an updated investment thesis based on the work we had conducted. Once the fund managers were in agreement with the attractiveness of this new growth opportunity, we developed a more complete analysis and report for their investors.

Impacts

Once approval was gained from the fund’s investment oversight group, we continued to work with this private equity fund and helped them to identify and acquire eight communications technology players, including candidate screening analysis, on-site visits as part of their due diligence as well as providing ongoing support to their operating partners working on integrating these businesses.

We have since worked on two additional investment opportunities for the fund, one of which is about to launch soon.

CLIENT

Leading $3 Billion Private Equity Fund Focused On Technology Enablement Opportunities

DELIVERABLES

Exploit Emergent Technologies

Validate Opportunities Via Due Diligence

Growth Strategy