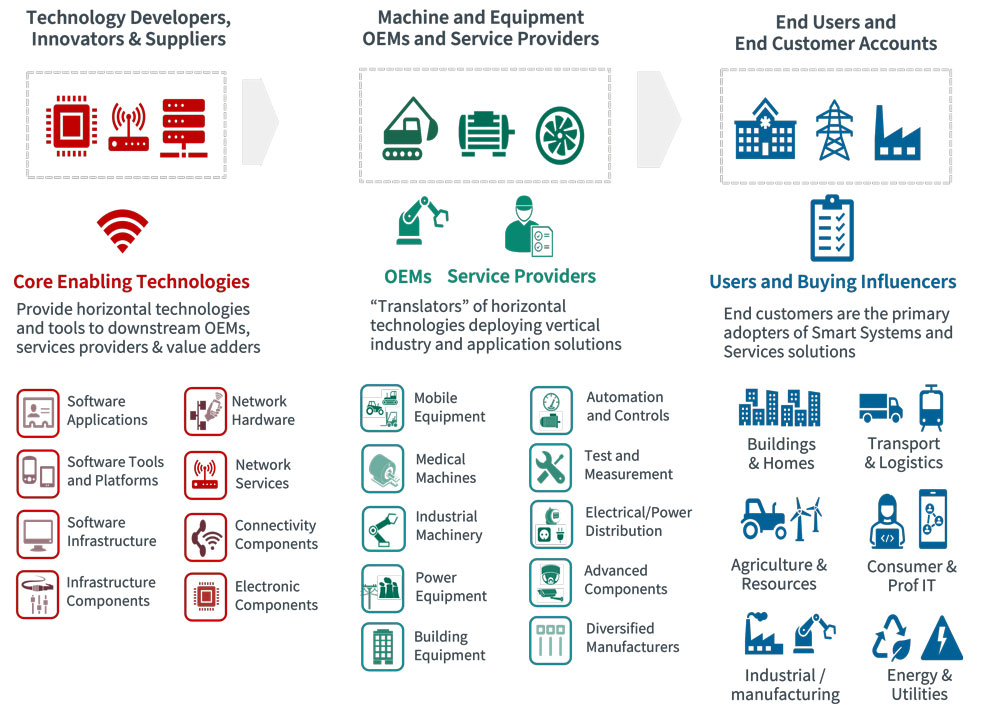

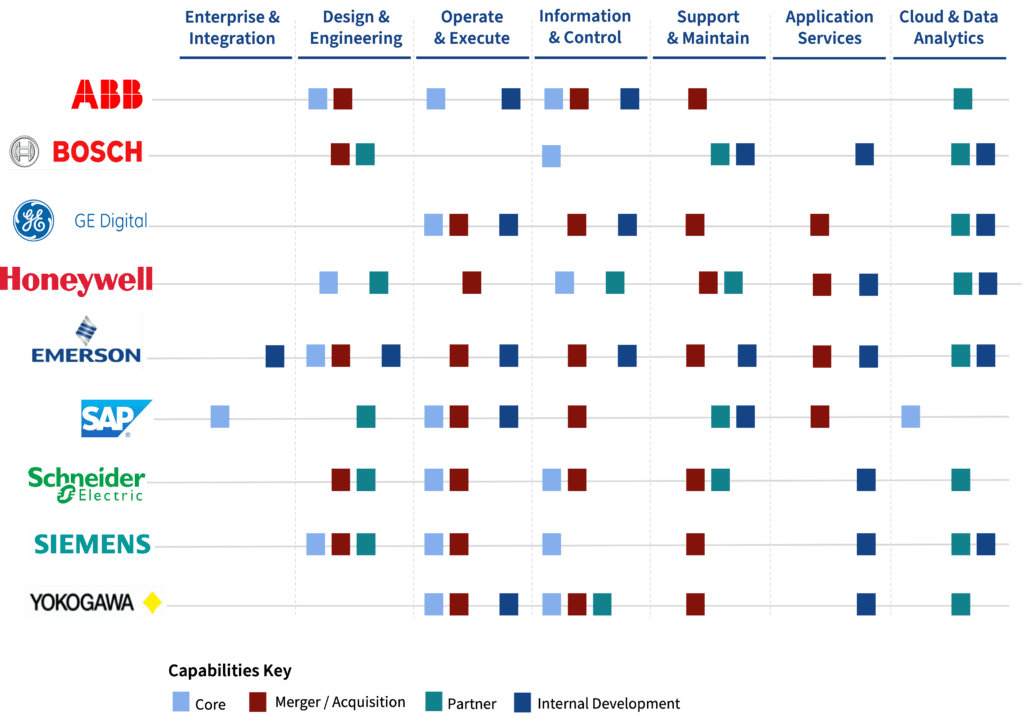

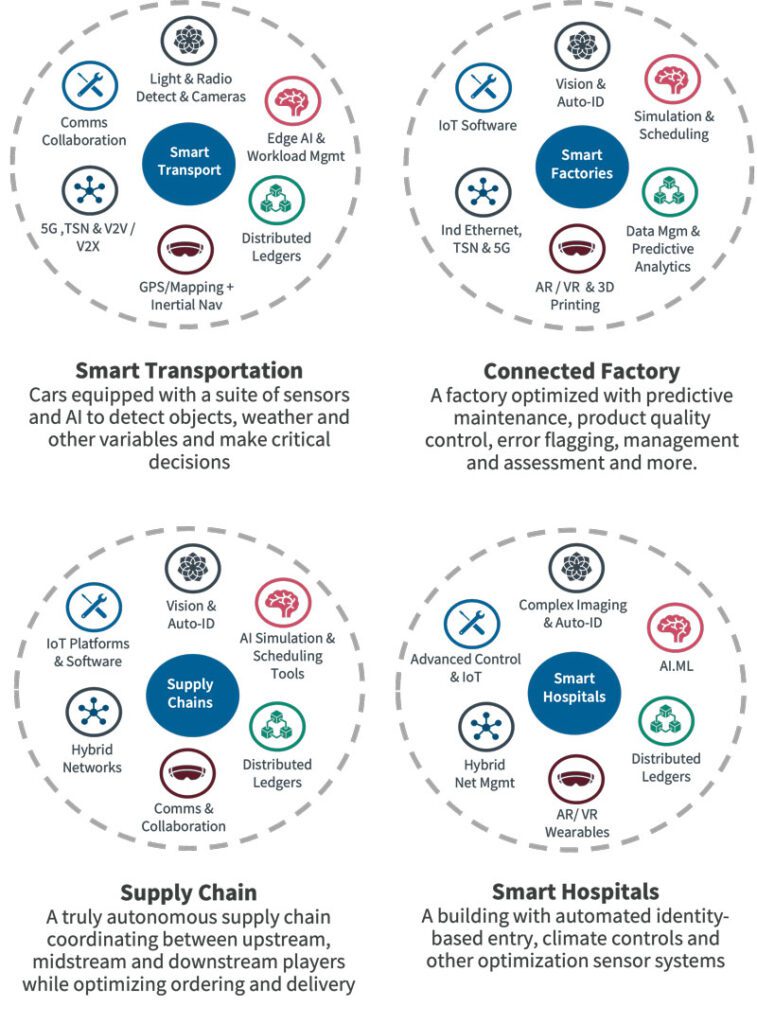

Machine and equipment players, particularly the largest ones like Siemens, ABB, Honeywell, Schneider Electric, Emerson, Bosch and more, continue to grapple with the shift in value from hardware to software. Many OEMs are trying very hard to leverage their core equipment businesses and value propositions with new software innovations. The question on everyone’s mind is, will any of these players really be able to break free from their past and create fundamentally new business models and value creation modes?”

Most of these OEMs share similar characteristics, organization structures, product development protocols, and sales and marketing practices. If you look at their history going back to the early 1990s, the OEM and equipment strategy playbook largely focused on global expansion, re-engineering, lean practices and acquisitions—all reasonable strategies at the time. But, somewhere between 2010 – 2015, OEMs realized that what worked in the past was less likely to work in the future. Indeed, many OEMs came to the realization that their traditional growth and value creation strategies had reached the point of diminishing returns.

At about the same time, many OEMs started to observe the insanely higher multiples software businesses were realizing in the equity markets. They realized their product development organizations were embedding software into most of the things they were manufacturing. Beyond that, software as a service was becoming the norm. Suddenly, software was becoming as germane to their businesses as a bearing is to a mechanical assembly.